Tidapay vs. Razorpay: no brainer when it comes to International Payments

Why you need to have a specialized provider when you want to sell international from India.

Empowering Digital Businesses to Scale Globally with Seamless Payments and Tax Compliance

Tidapay is designed specifically for digital businesses looking to scale globally. Unlike Razorpay, which primarily focuses on domestic payments and basic international processing, Tidapay offers a Merchant of Record (MoR) model that ensures hassle-free cross-border transactions, compliance management, and global payouts.

Merchant of Record Advantage

Handles sales tax, compliance, and chargebacks, allowing businesses to focus on growth.

Comprehensive Tax Compliance

Automatically manages GST, TDS, and international remittances, reducing the administrative burden on founders.

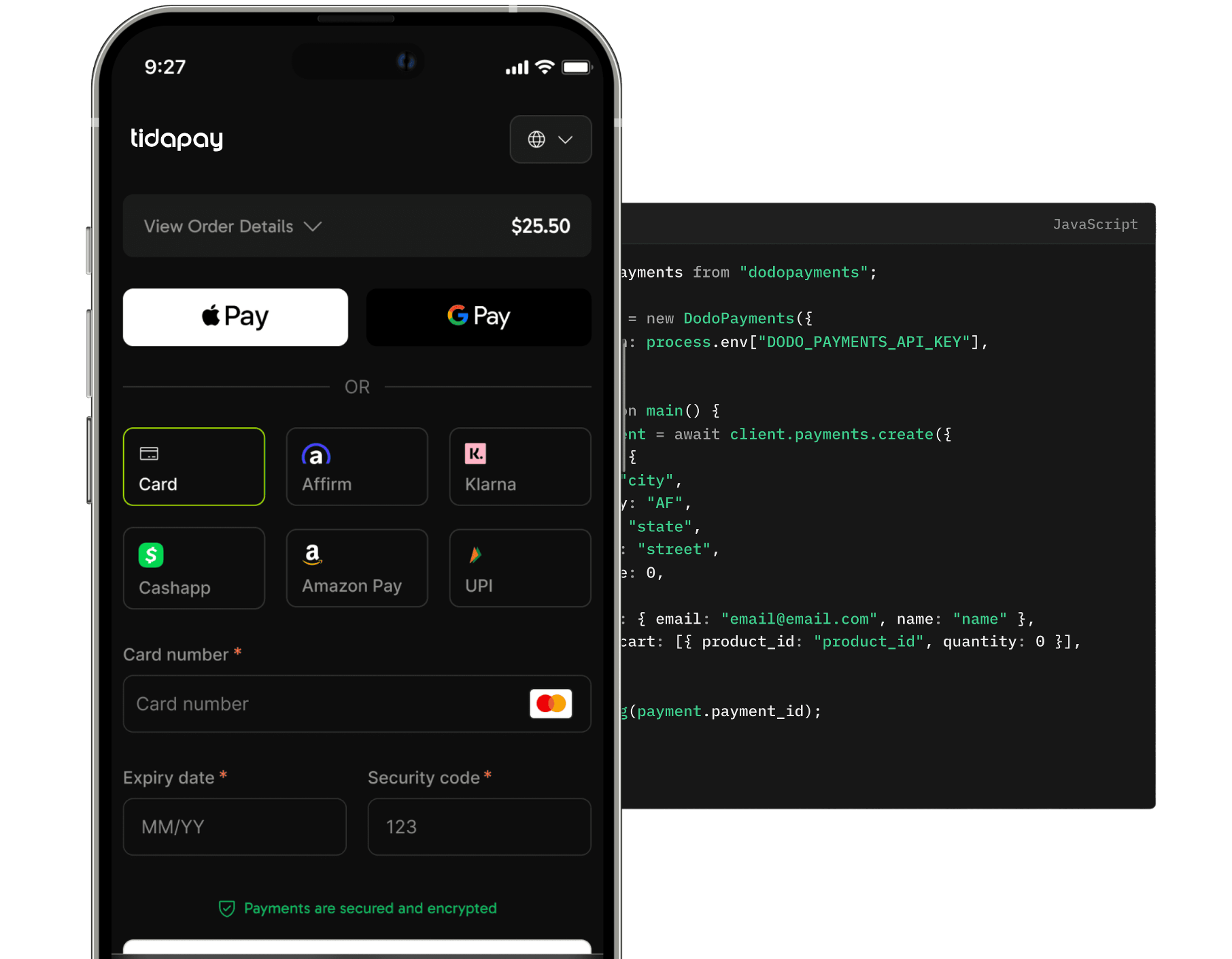

No-Code & Low-Code Integration

Offers easy setup options without extensive developer effort

Built for Digital Businesses Scaling Globally

Tidapay simplifies cross-border transactions, ensuring seamless tax handling and compliance.

Tidapay vs Razorpay: Stay Razor Sharp With Your Payments

Discover how Tidapay goes beyond Razorpay with tax compliance, local payment gateways, and a focus on scaling digital businesses globally.

|

Features

|

|

Razorpay

|

|---|---|---|

| Primary Audience | Digital Businesses | Indian startups, eCommerce businesses, service providers |

| Global Tax Compliance | Built-in automation for GST, VAT, and cross-border taxes | Users must manually handle tax compliance |

| Supported Payment Gateways | Extensive local payment options for India, US and more | Primarily supports domestic and limited international gateways |

| Merchant of Record (MoR) | Fully included for global tax compliance | Only focused as a Payment Gateway |

| Transaction Fees | Transparent, affordable fees for founders | Gateway fees, plus additional international transaction charges |

| Customer Support | Personalized onboarding and 24/7 support Founder friendly support | Standard support with limited international compliance guidance |

| Platform Focus | SaaS and digital product businesses | Payment processing gateway with limited global tax support |

| Onboarding Experience | Quick onboarding: New merchants are prioritized as much as anyone regardless of their MRR | Setting up international payments and tax automation may involve additional effort |

Built for your Industry

From SaaS to marketplaces, travel to freelancers unlock seamless payments with 25+ payment methods, global reach, and automated tax handling.

Artificial Intelligence

Software as a Service(SaaS)

Content

EdTech

Consumer

Digital Products

Everything You Need to Power Global Payments

From checkout to compliance, we’ve got you covered.

What Our Customers Are Saying

Hear how Tidapay is transforming businesses around the world

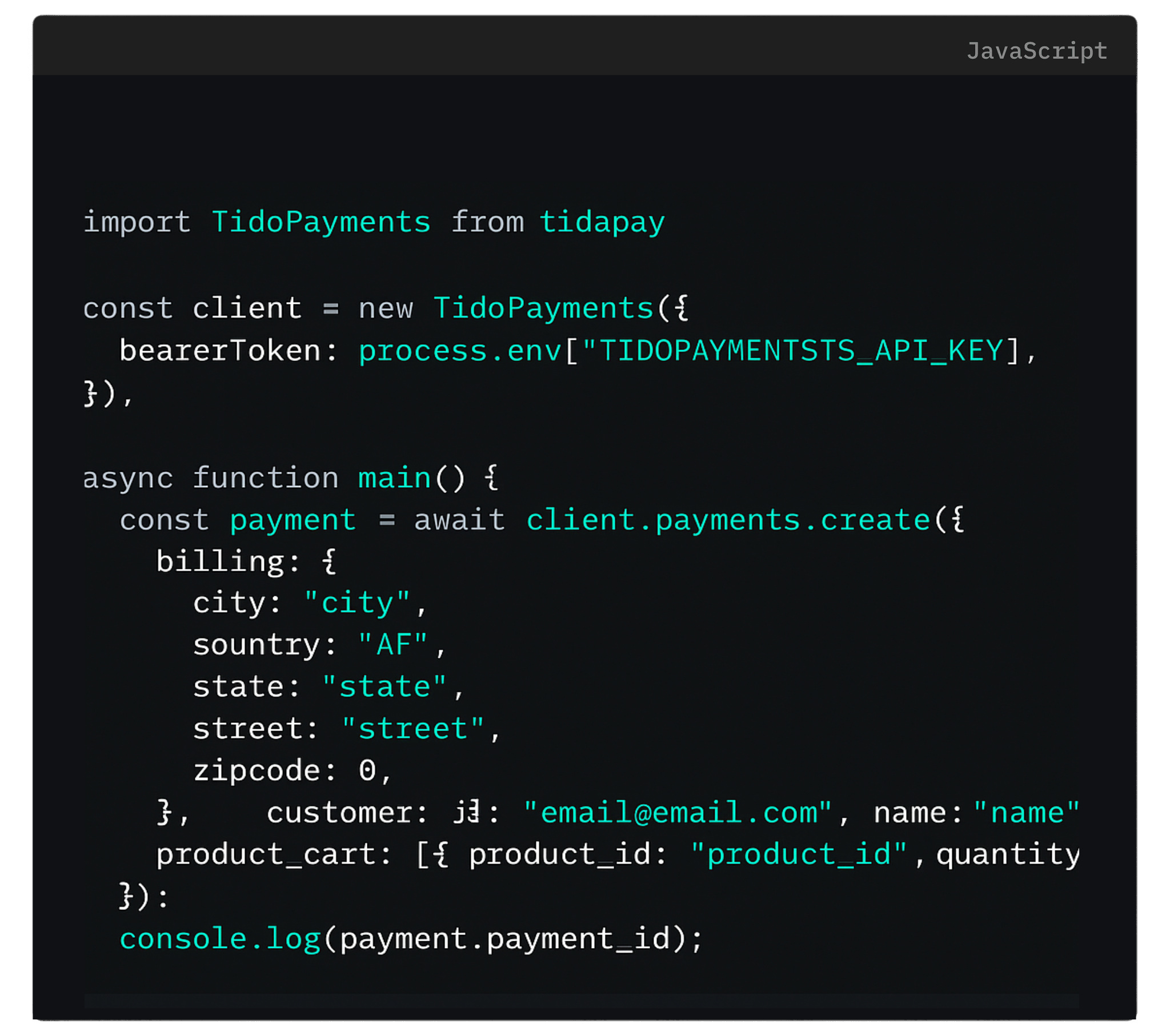

Developer Resources

Access powerful APIs and SDKs designed for seamless integration, secure transactions, and robust customization across multiple platforms and languages.

API & Webhooks

Automate billing, renewals, and subscription management with flexible, developer-first APIs and real-time webhooks.

Plugins & Integrations

Integrate seamlessly with your stack using pre-built plugins for top platforms, powering global sales and local compliance effortlessly.

Mobile SDKs

Build rich in-app payment experiences with our lightweight and secure React Native SDKs optimized for iOS and Android.

Language SDKs

Speed up development with SDKs for Kotlin, Go, PHP, Python, Node.js, and Ruby crafted for fast, secure, and customizable payment integration.

Frequently Asked Questions

Keep up to date with unlimited wallets in view-only mode by entering an address